Our lessees must comply with all local, state, and federal regulations. And they are required to obtain necessary local, state, and federal permits. Additionally, all of our lessees are required to follow our site-specific stewardship stipulations. Violating stewardship stipulations may result in lease termination.

The Colorado Energy and Carbon Management Commission (ECMC) is the regulatory agency for oil and gas development in the State of Colorado. The State Land Board is a separate agency from the ECMC. Our agency and our lessees are subject to the same local, state, and federal rules and requirements as any private land owner.

Oil and gas payers must continue to file the standard royalty production data by the established deadlines. To file production data for wells that are impacted by the negative market, insert a zero value in the Royalty Paid field of our Royalty Report Form. The Land Board cannot accept credits against royalty in an inverted market.

For information regarding bitcoin mining, view the document 'bitcoin mining notice to operators.'

I have questions about oil and gas development at Lowry Ranch. Who can I contact?

Please read our webpage for more information about the history of oil and gas development at Lowry Ranch as well as current and proposed development.

Who owns the minerals under my house/land? Oil and gas auction info and results Submit an auction nomination online Didn't find what you're looking for on our self-serve map? Submit a CORA request. Disposal wells Royalty informationThe State Land Board owns 3,990,000 acres of mineral estate. The state received this acreage at statehood (1876) from the federal government.

Today we have 990 active oil and gas leases covering approximately 400,000 acres of mineral estate. These leases resulted in approximately $1.5 billion earned for trust beneficiaries -- Colorado schoolchildren -- in the past 15 years.

Yet only 12% are actually produced: 88% of oil and gas leases on trust lands never go into production, i.e. no extraction occurs.

View a slideshow about oil and gas development on trust land in Colorado or read a text-only version of the timeline:

The State Land Board offers oil and gas leases by competitive auction. Auctions typically take place in April, August, and December of each year. Auctions occur online through our third-party auctioneer EnergyNet. Pre-registration with EnergyNet is required to participate in the auction. Read more about the auction process, nomination information, and results.

Other oil and gas leases are issued through our application process. Scroll below to Forms and Instructions to select the application you need.

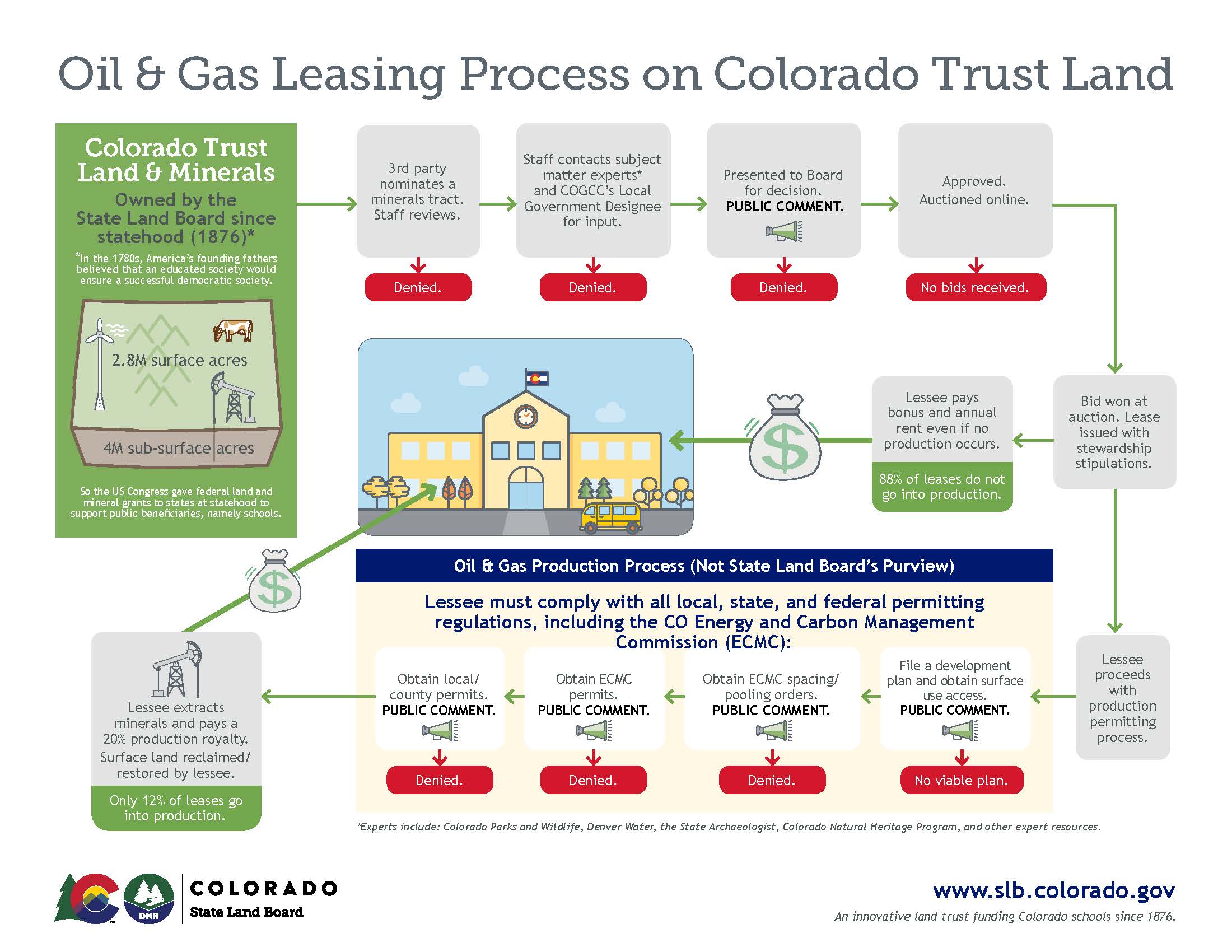

This diagram depicts the leasing process. Read a text-only version of the diagram.

Leases on trust land support Colorado public schools, per the state Constitution. Watch our short video about why we're proud that oil and gas leasing on trust lands has earned nearly $1.5 billion for Colorado's public schools in the past 15 years:

Oil and gas leases are issued at auction for a primary term of five years. An annual rental is applicable for the life of the lease; currently, the rate is $2.50/acre. The Board’s current royalty rate is 1/5th with no deductions allowed for post-production costs.

Sixty days prior to the end of the primary term of the lease, a lessee may request an additional one (1) year extension (sixth-year extension) that is at staff discretion; additional one (1) year extensions beyond the sixth-year may be approved by the Board. Lessees should contact the Oil and Gas Specialist at minimum three months prior to the anniversary date of the lease if a lease extension is desired that must be approved by the Board.

State Land Board leases require a performance bond, which is separate from the bonding required by the Colorado Energy & Carbon Management Commission (ECMC). State Land Board bonds are required by statute to prevent waste of state trust assets and can cover items such as (but not limited to) surface reclamation, rentals, and royalties. Bonds are required prior to accessing the surface of the property, commencing operations, or any disturbance on the land.

State leases do not have a pooling provision. In order to join state trust minerals with other minerals outside the lease (including a second state trust lease), a Communitization Agreement must be approved by the State Land Board. Communitization Agreement Guidelines and the Communitization Agreement form are available under Forms and Instructions.

Can I cancel my lease at any time prior to development?Yes. All oil and gas leases have a surrender clause that allows the lessee to surrender all or a portion of the leased land, by paying all amounts due and submitting a written surrender request to the State Land Board.

To prevent unwanted rental charges, the State Land Board encourages lessees to notify the agency in writing of a request to surrender a lease. Surrender requests should be emailed to the Oil and Gas Specialist, Catie Stitt , prior to the next anniversary date of the lease. Lessees that stop paying rent without providing a proper written surrender request can be charged prorated rent. Prorated rental charges are calculated based on a timeframe that includes the State Land Board’s determination of non-payment of rent, notification period to the lessee for the unpaid rent, and time to cure a default under the terms of the lease.

For partial surrenders: only contiguous tracts totaling a minimum of 40 acres in a lease can be surrendered (unless the original lease was for less than 40 acres).

If the surrendered lease has been recorded in the county, a Release of Lease or Memorandum of Release must also be recorded in the county when the lease is relinquished and a copy of the recorded Release submitted to the State Land Board for the lease file.