Welcome to our blog where we shed light on the concept of “Specified Employees” and their potential tax implications. In the realm of income tax regulations, Specified Employees hold a crucial position. They are individuals with a certain level of equity shareholding or voting power in a company. As we delve into this topic, we’ll explore the criteria that will actually define that Who are the Specified Employees? and how their taxation might differ from that of other employees. Join us as we demystify this aspect of the tax landscape and provide clarity on its significance for both employees and employers.

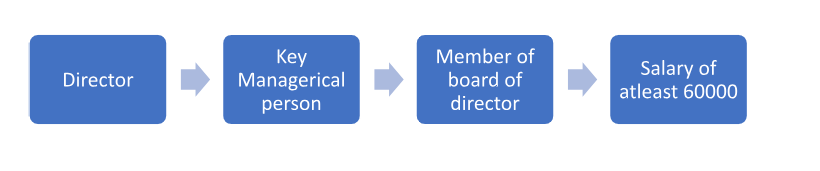

A “Specified Employee” in India is a person who:

Additionally, the term “Specified Employee” is defined in the Companies Act 2013 and the Income Tax Act 1961 .

To comprehend the taxability of salary and wages for specified employees in India, it is necessary to first define “salary” and “wages.” A salary is a fixed quantity of money paid to an employee by his or her employer, usually monthly. In contrast, wages are a variable sum of money paid by an employer to an employee, typically on an hourly basis.

Now, let us examine the taxability of salaries and compensation for specified Indian employees. The Income Tax Act of 1961 specifies the taxability of salaries and compensation for specified Indian employees. According to the Income Tax Act of 1961, an employee’s salary and compensation from a specified employer are taxable in India.

Exceptions to the rules:

Bonuses and other forms of compensation paid to certain employees in India are subject to taxation. The 1961 Income Tax Act governs the taxability of incentives and additional compensation paid to specified employees. The Income Tax Act of 1961 defines a “specified employee” as an employee who is employed by a public sector company or a non-public sector company and whose annual compensation exceeds 1,00,000 from their employer.

If the bonus or other compensation is paid in cash, the employee must pay income tax at the applicable rate on the amount. If the bonus or other compensation is paid in the form of property, the employee must pay income tax at the applicable income tax rate on the property’s fair market value.

Stock options’ taxability depends on the option type, exercise price, holding period, and employee tax bracket.

The option type influences how it is taxed. Consider a non-qualified stock option. When exercising, the employee pays ordinary income tax on the difference between the exercise price and the stock’s fair market value.

The employee pays capital gains tax on the difference between the exercise price and the stock’s fair market value at sale if the option is qualified. The exercise price also affects stock option taxability. The employee can buy stock at the exercise price. If the exercise price is less than the stock’s fair market value, the difference is taxed as ordinary income. If the exercise price exceeds the stock’s fair market value, the difference will be taxed as a capital gain.

Employees must wait the holding period before trading shares. The reserve must be kept for less than a year to be taxed as a short-term capital gain or loss . Long-term capital gains or losses on shares held for more than a year are taxed.

The employee’s tax categorization also affects stock option taxation. Higher tax classifications and regular income have higher tax rates than capital gains. Thus, if the option is treated as ordinary income, the employee’s tax rate will be higher than if it is capital gain.

Taxable Value = Employer’s Manufacturing Cost – Amount Recovered from Employee

In conclusion, Specified Employees hold a distinctive status under income tax regulations, primarily due to their ownership or control over a company through equity shares or voting power. This unique classification often leads to divergent tax treatment, particularly in scenarios involving employee stock options. As we’ve explored, their tax liability can vary based on factors such as exercise timing and vesting periods. As tax laws evolve, it’s imperative for both employees and employers to stay updated on the latest provisions to ensure compliance and optimize tax planning.