Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. The annual dividend per share divided by the share price is the dividend yield.

A dividend’s value is determined on a per-share basis and is to be paid equally to all shareholders of the same class (common, preferred, etc.). The payment must be approved by the Board of Directors.

When a dividend is declared, it will then be paid on a certain date, known as the payable date.

Steps of how it works:

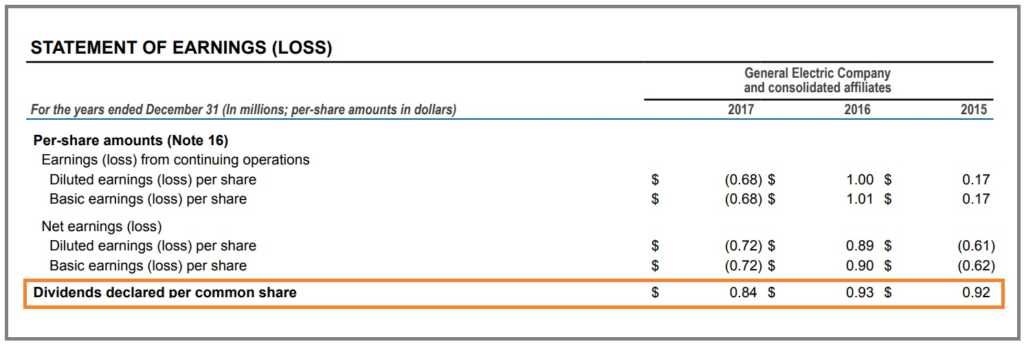

Below is an example from General Electric’s (GE)’s 2017 financial statements. As you can see in the screenshot, GE declared a dividend per common share of $0.84 in 2017, $0.93 in 2016, and $0.92 in 2015.

This figure can be compared to Earnings per Share (EPS) from continuing operations and Net Earnings for the same time periods.

There are various types of dividends a company can pay to its shareholders. Below is a list and a brief description of the most common types that shareholders receive.

Types include:

When a company pays a dividend it is not considered an expense since it is a payment made to the company’s shareholders. This differentiates it from a payment for a service to a third-party vendor, which would be considered a company expense.

Managers of corporations have several types of distributions they can make to the shareholders. The two most common types are dividends and share buybacks. A share buyback is when a company uses cash on the balance sheet to repurchase shares in the open market. This has two effects.

(1) it returns cash to shareholders

(2) it reduces the number of shares outstanding.

The reason to perform share buybacks as an alternative means of returning capital to shareholders is that it can help boost a company’s EPS. By reducing the number of shares outstanding, the denominator in EPS (net earnings/shares outstanding) is reduced and, thus, EPS increases. Managers of corporations are frequently evaluated on their ability to grow earnings per share, so they may be incentivized to use this strategy.

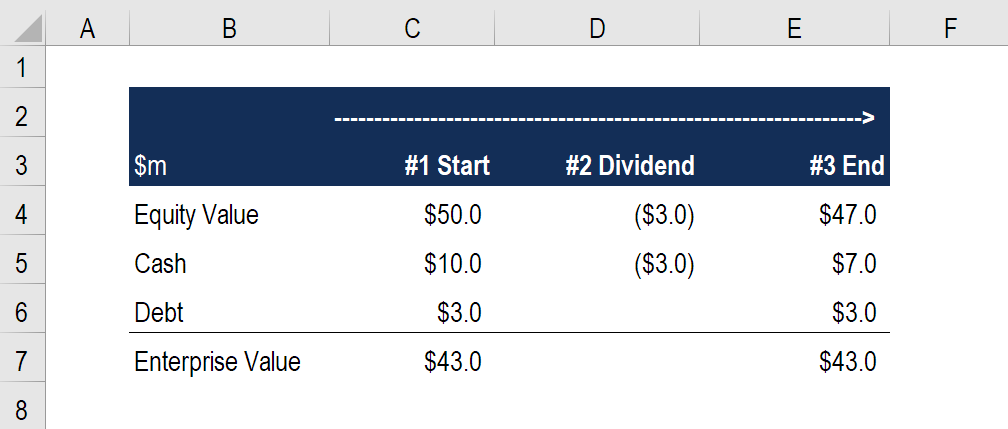

When a company pays a dividend, it has no impact on the Enterprise Value of the business. However, it does lower the Equity Value of the business by the value of the dividend that’s paid out.

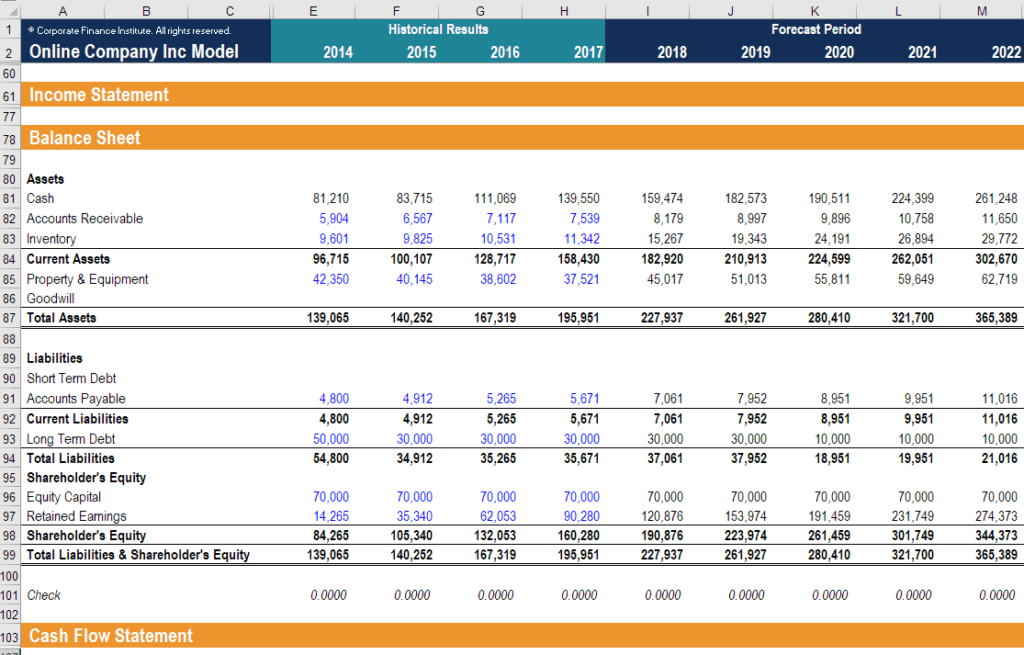

In financial modeling, it’s important to have a solid understanding of how a dividend payment impacts a company’s balance sheet, income statement, and cash flow statement. In CFI’s financial modeling course, you’ll learn how to link the statements together so that any dividends paid flow through all the appropriate accounts.

A well-laid out financial model will typically have an assumptions section where any return of capital decisions are contained. For example, if a company is going to pay a cash dividend in 2021, then there will be an assumption about what the dollar value will be, which will flow out of retained earnings and through the cash flow statement (investing activities), which will also reduce the company’s cash balance.

Thank you for reading CFI’s guide to Dividends. To keep advancing your career, these additional CFI resources will be useful:

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

Get Certified for Financial Modeling (FMVA)®Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.